The number of biotech companies in Singapore is expected to grow by more than 60 percent over the next 10 years, but a talent shortage continues to pose challenges for organisations in this sector, according to a new report released by SGInnovate.

Bridging the Talent Gaps in Singapore’s Biotech Sector, commissioned by Deep Tech ecosystem builder and investor SGInnovate and conducted by global strategy firm LEK Consulting, highlights talent trends and market sentiments concerning the growth of the biotech sector in Singapore. The insights in this report have been drawn from interviews with key stakeholders in the ecosystem, including government agency representatives, biotech CEOs and venture capital firm executives.

The study looked at companies across three broad phases of growth – pre-clinical, clinical and commercialised, while also examining the needs of biotech talent at three levels of seniority – junior, manager and C-suite / board.

“Building on the insights from this report, SGInnovate is working closely with other key stakeholders in the biotech entrepreneurship ecosystem to anticipate and deliver the support companies need, especially in areas such as talent development,” said Juliana Lim, Executive Director – Talent, SGInnovate. “All the components of this ecosystem must work in tandem to sustain the success of Singapore’s biotech sector and enable it to make an impact globally.”

Capturing opportunities in tomorrow’s biotech economy

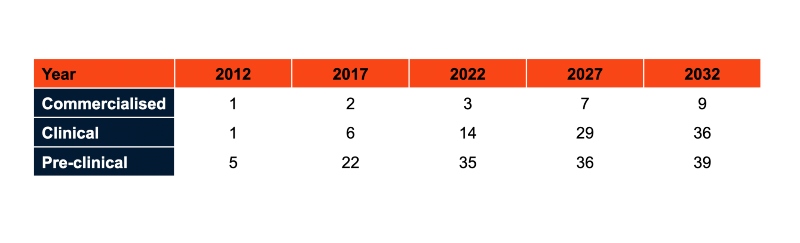

Supported by government and private sector investments in research & development, the number of biotech companies in Singapore is expected to increase steadily between 2022 and 2032, with the number of clinical-phase companies more than doubling over the next decade. More biotech companies are also expected to enter the commercial phase, with the total tripling between 2022 and 2032.

Estimated number of biotech companies in Singapore

Meanwhile, pre-clinical phase biotech companies have experienced a decade of rapid expansion between 2012 and 2022, with the number of companies in this phase increasing seven-fold from five in 2012, to 35 in 2022. This growth is expected to stabilise over the next 10 years as the ecosystem matures, with some companies entering the clinical phase, while new startups pioneering frontier research are incorporated.

The study also recognises startups as a key engine of innovation within the sector, as global pharmaceutical companies build therapeutics pipelines with new models that include acquiring, co-developing with, or licensing from smaller biotech companies.

Talent gaps challenging Singapore’s biotech ambitions

While the outlook for Singapore’s biotech sector is positive overall, a shortage of key talent across the various functions and experience levels continues to pose challenges for biotech companies, with the overall talent shortage expected to grow by about 30 percent, from 154 in 2022 to 199 in 2032. The study also highlighted key functions where a shortage of talent is expected in Singapore, such as roles in research & development, production, regulatory affairs and business management.

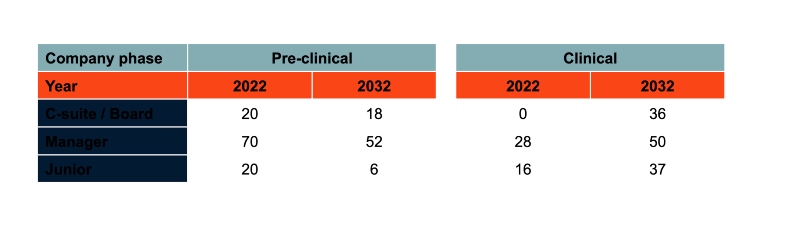

Projected biotech talent gap in Singapore in 2022 and 2032

The pre-clinical phase talent gap – particularly with junior-level roles – is expected to narrow as the rate of growth in pre-clinical companies steadies, potentially filled by research professionals looking to gain hands-on industry experience with companies at this stage. From a shortage of more than 100 personnel in 2022, the gap is expected to decrease by approximately 30 percent to 76 in 2032, with the shortfall centred primarily on manager-level talent.

In contrast, the talent gap in the clinical phase is expected to see an almost three-fold increase, from a shortage of 44 personnel in 2022, to 123 in 2032. At this phase, the gap is most critical at the C-suite level – professionals that can support business management activities such as fundraising and business direction, as well as manager-level roles, who drive vendor and third-party engagement.

Paving the way for talent development in the ecosystem

To address these talent shortages and support academic and research professionals keen to take up roles with biotech companies, the study identified initiatives that can be implemented by ecosystem stakeholders.

In the pre-clinical phase, one of the key issues companies face is a lack of professionals with managerial skills. Potential measures to mitigate this issue noted in the study include programmes to develop talent internally with companies, as well as initiatives to supplement the local talent pool with suitable professionals from overseas, such as:

- Biotech companies can accelerate career progression for experienced juniors reaching managerial level, through rotations and secondments

- Incentives for talent to relocate from overseas

The study also highlighted a need to encourage pre-clinical clinical research organisations (CROs) to set up in Singapore, to provide professionals with opportunities to manage the outsourcing of experiments in pre-clinical settings.

In the clinical phase, training must focus on all levels to support the expected growth in number of companies at this phase. Where numbers allow, biotech companies should be incentivised to conduct Phase II and III clinical trials locally, to allow professionals to gain experience with industry-level operations. Singapore can also position itself as a facilitating hub for trials in the Asia-Pacific region, especially for local and overseas biotech companies that target this market.

“While the talent gap remains a perennial issue for biotech companies globally, the demand for expertise in these areas presents an opportunity for researchers and academia to gain industry exposure,” added Lim. “Over time, with the right training resources and support at each stage of development, we can expect these researchers to accumulate the experience needed to step up and lead startups that are pioneering cutting-edge research. SGInnovate will continue to work with public and private sector partners to ensure that appropriate support is available for talent as they pursue various development paths in the industry and drive growth of the ecosystem.”