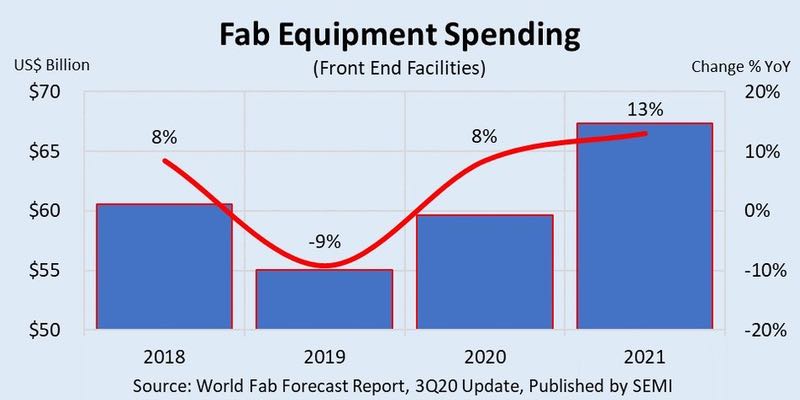

Soaring pandemic-inspired demand for chips that power everything from communications and IT infrastructures to personal computing, gaming and healthcare electronics will drive an 8% increase in global fab equipment spending in 2020 and a 13% increase in 2021, SEMI announced in its World Fab Forecast report.

Rising demand for semiconductors for datacenter infrastructures and server storage along with the buildup of safety stock as US-China trade tensions intensify are also contributing to this year's growth.

The bullish trend for overall fab equipment investments comes as the semiconductor industry recovers from a 9% decline in fab spending in 2019 and navigates a roller-coaster 2020 with actual and projected spending drops in the first and third quarters mixed with second- and fourth-quarter increases.

Of all chip sectors, memory will see the largest spending increase in 2020, growing $3.7 billion, or 16% year-over-year (YoY), to $26.4 billion, and tack on an 18% increase to reach $31.2 billion in 2021. 3D NAND spending will log the largest percentage surge this year, expanding 39%, and register modest growth of 7% in 2021. DRAM is expected to see 4% growth after a slowdown in the second half of 2020 before jumping 39% next year.

Equipment spending forecasts for other semiconductor sectors:

- Foundry, the next largest sector in equipment spending for 2020, is forecast to rise $2.5 billion, or 12% YoY, to $23.2 billion and edge up 2% to $23.5 billion in 2021.

- MPU equipment spending will decline $1.2 billion, or 18%, in 2020 and rise 9% to $6 billion in 2021.

- Analog spending will grow a robust 48% in 2020 and rise 6% in 2021, an expansion chiefly driven by equipment investments for mixed-signal/power fabs.

- Image sensors equipment spending is expected to rise 4% to US$3 billion in 2020 and jump 11% to US$3.4 billion in 2021.

The SEMI World Fab Forecast report covers more than 1,300 fabs and lines and includes capacity and technology by fab and construction investments. The report shows 21 new construction projects - ranging from R&D to volume and including high- and low-probability parameters - starting in 2020. China accounts for the most (nine) of the new projects; followed by Taiwan at five; Southeast Asia and the Americas at two each; and Japan, Korea, and Europe/Mideast at one each. The report also tracks 18 new construction projects planned to begin next year - 10 in China, four in the Americas, three in Taiwan, and one in Europe/Mideast.